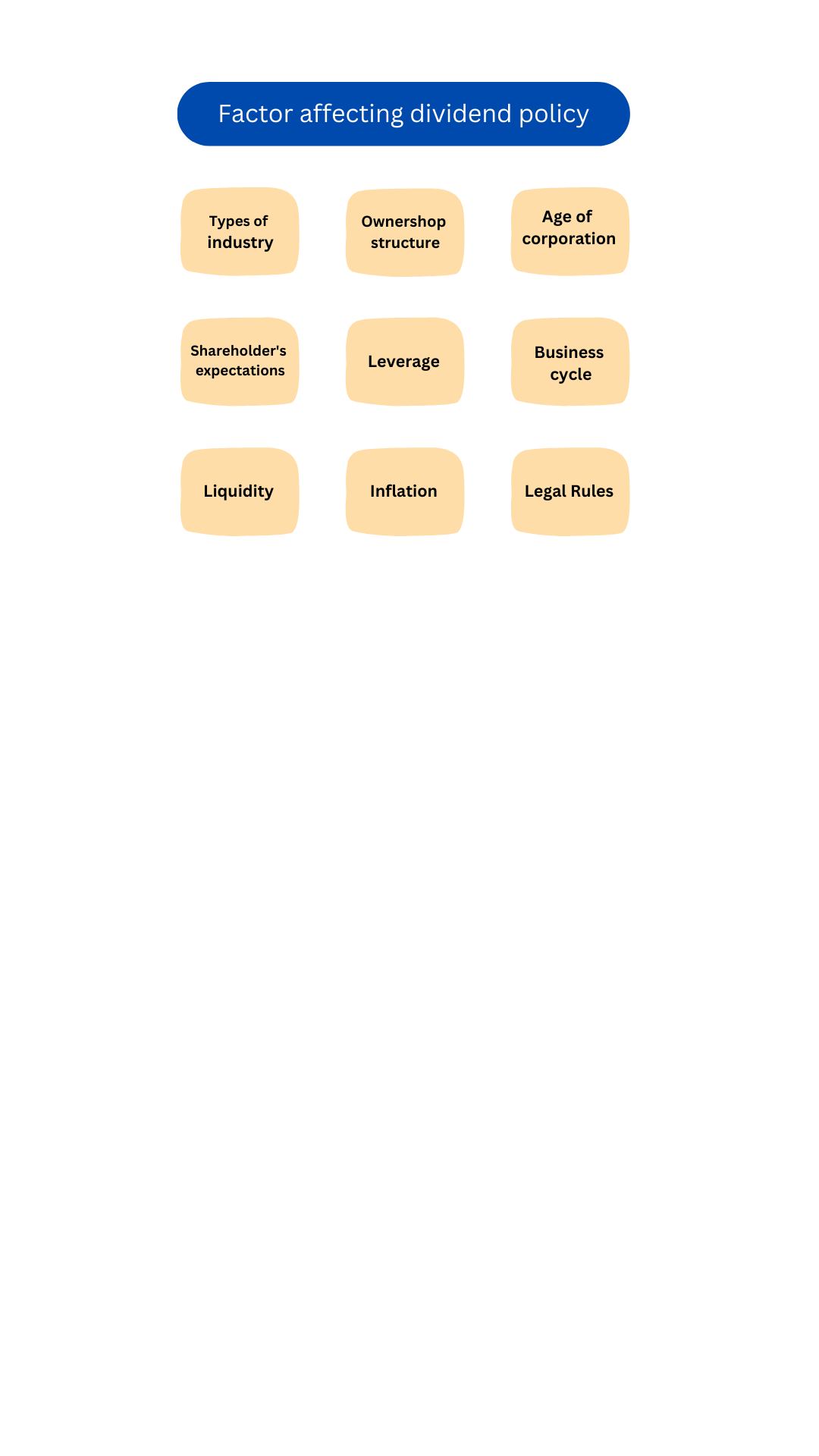

Factor Affecting Dividend Policy

Dividend policy is the decision of a company regarding the amount of profits to be distributed to shareholders as dividends and the timing of those distributions. Several factors can affect a company’s dividend policy, including:

Earnings and cash flow: A company’s dividend policy is closely tied to its earnings and cash flow. If a company has consistent and stable earnings and cash flow, it is more likely to have a predictable dividend policy.

Investment opportunities: If a company has profitable investment opportunities, it may choose to reinvest its earnings instead of paying dividends. This may lead to a lower dividend payout or even no dividend payout.

Debt levels: A company with high levels of debt may choose to reduce its dividend payout to ensure it has enough cash to meet its debt obligations.

Shareholder preferences: Shareholders may have different preferences for dividends. Some may prefer a high dividend payout, while others may prefer the company to retain earnings for future growth.

Regulatory environment: Certain regulations may affect a company’s dividend policy, such as tax laws or capital requirements.

Industry norms: Dividend policies can also be affected by industry norms. For example, companies in mature industries with stable earnings tend to have higher dividend payouts than companies in growth industries.

Economic conditions: Economic conditions such as inflation, interest rates, and the overall economic environment can also affect a company’s dividend policy. Inflation and rising interest rates can increase a company’s borrowing costs and reduce the amount of cash available for dividend payments.

In summary, a company’s dividend policy is influenced by a variety of factors, including its earnings, cash flow, investment opportunities, debt levels, shareholder preferences, regulatory environment, industry norms, and economic conditions. Understanding these factors is essential for companies to make informed decisions about their dividend policies.