Introduction to finance

Finance is the study of how individuals, businesses, and organizations manage money and investments. It involves analyzing financial data to make decisions about how to allocate resources, raise capital, and invest funds to maximize returns.

There are several key areas within finance, including corporate finance, investments, financial institutions and markets, and personal finance. In corporate finance, the focus is on managing the finances of businesses, including making decisions about how to finance operations, manage risk, and invest profits. Investments involves analyzing financial markets and making investment decisions to maximize returns while managing risk. Financial institutions and markets involve the study of financial intermediaries such as banks, stock exchanges, and other financial institutions. Finally, personal finance involves managing one’s own money and making decisions about investments, savings, and retirement planning.

Overall, finance plays a critical role in the economy, as it helps individuals and organizations manage money effectively and make sound investment decisions.

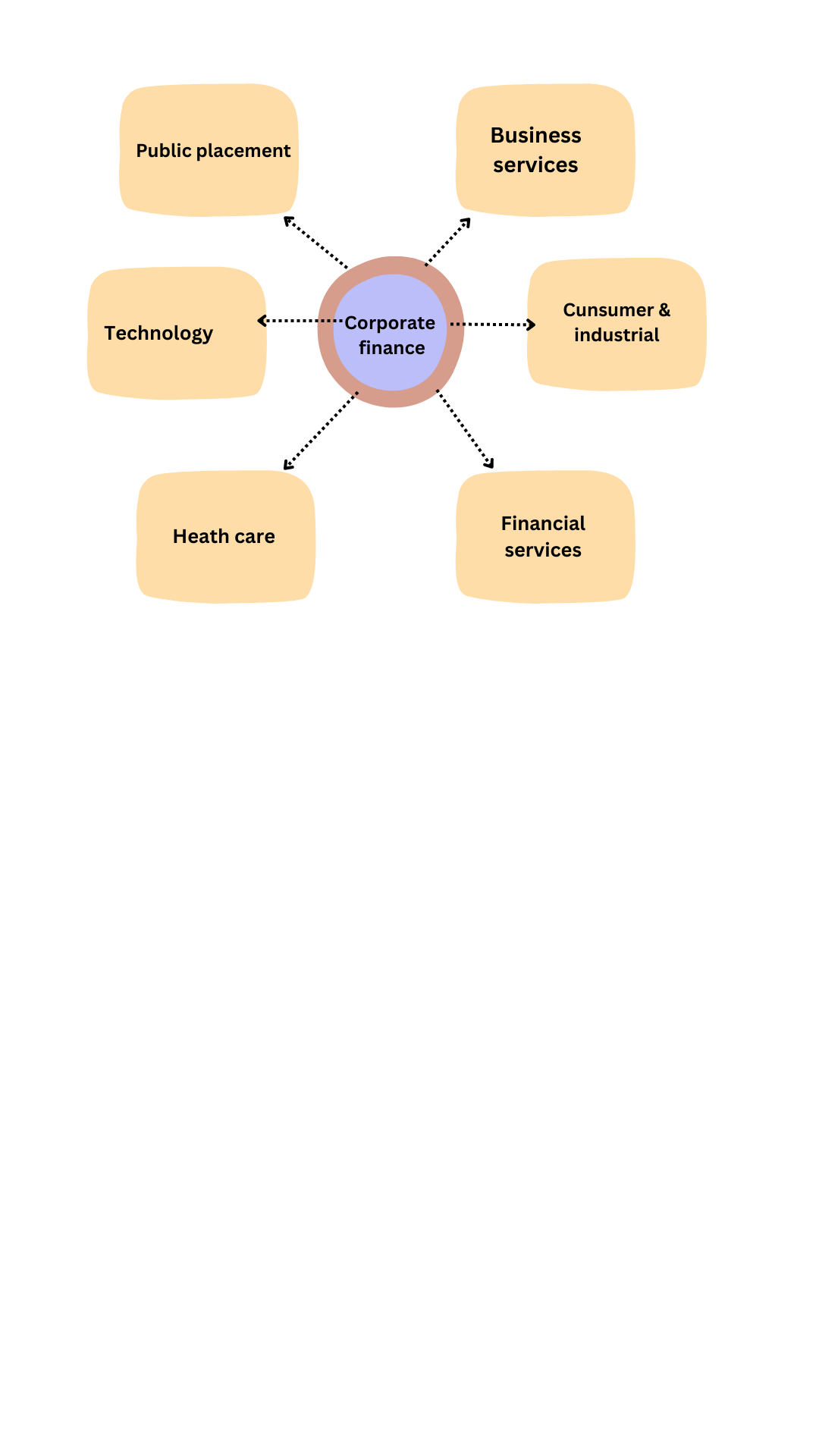

The scope of corporate finance includes several areas:

Investment decision-making: This involves analyzing potential investment opportunities and deciding which projects to pursue based on their expected returns and risk profiles.

Financing decision-making: This involves deciding how to fund the company’s operations and investments, including determining the mix of debt and equity financing.

Capital structure management: This involves managing the company’s capital structure, including determining the optimal level of debt and equity, and maintaining an appropriate balance between the two.

Risk management: This involves identifying and managing financial risks such as interest rate risk, currency risk, and credit risk.

Dividend policy: This involves deciding how to distribute profits to shareholders through dividends and share buybacks.

Financial reporting and analysis: This involves preparing financial statements and analyzing financial data to provide insights into the company’s financial performance.

Overall, corporate finance plays a critical role in ensuring the long-term success of a company by helping it make sound financial decisions and manage its resources effectively.

Corporate Governance and Agency Problem

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It includes the processes by which a company’s goals are set and achieved, the means by which performance is monitored and evaluated, and the mechanisms by which accountability is ensured.

The agency problem refers to the conflict of interest that arises between a company’s management and its shareholders. Managers are hired by shareholders to run the company on their behalf, but may not always act in the best interests of shareholders. This is because managers may have different goals and incentives than shareholders, and may prioritize their own interests over those of shareholders.

Corporate governance plays an important role in addressing the agency problem by providing mechanisms for aligning the interests of managers and shareholders. For example, a board of directors is responsible for overseeing management and ensuring that they act in the best interests of shareholders. The board is also responsible for setting compensation policies that align the interests of managers with those of shareholders, such as stock options that provide incentives for managers to increase shareholder value.

Other mechanisms for addressing the agency problem include shareholder activism, where shareholders use their voting power to influence company decisions, and external monitoring by auditors and regulators.

Overall, effective corporate governance is essential for ensuring that companies are managed in a way that maximizes shareholder value and minimizes the agency problem.